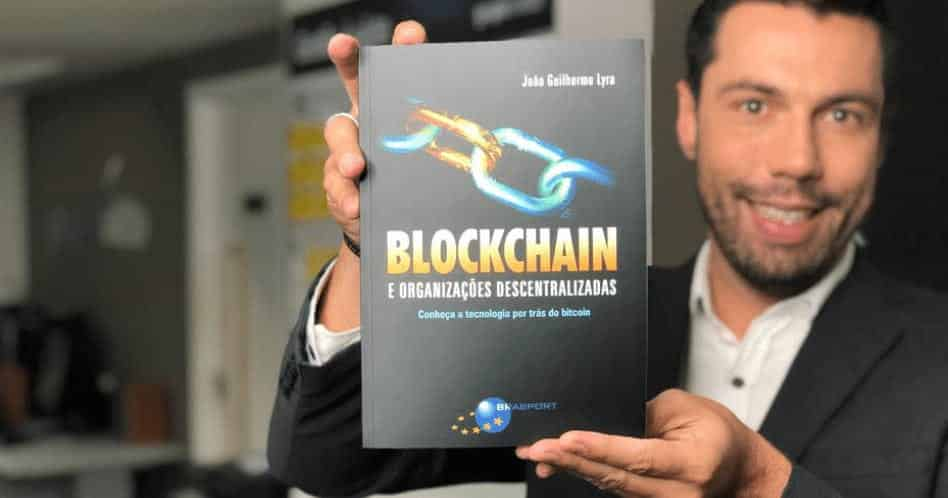

Blockchain and Decentralized Organizations - João Guilherme Lyra

Understand why Bitcoin has revolutionized the way we conduct economic transactions between two individuals without the need for a third party. Learn about the technology behind digital currency and its impacts on our lives.

Choose language: