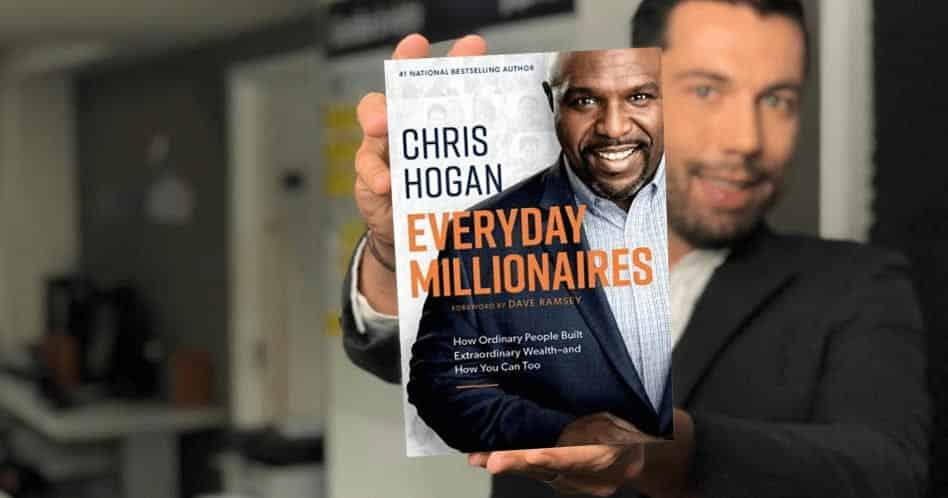

Everyday Millionaires - Chris Hogan

To become a millionaire, you don't need to inherit something or earn an astronomical salary! There are tools that you have mastered, or can learn to master easily, that will help you achieve financial independence.

Choose language: